Climate Risk Assessment and Disclosure

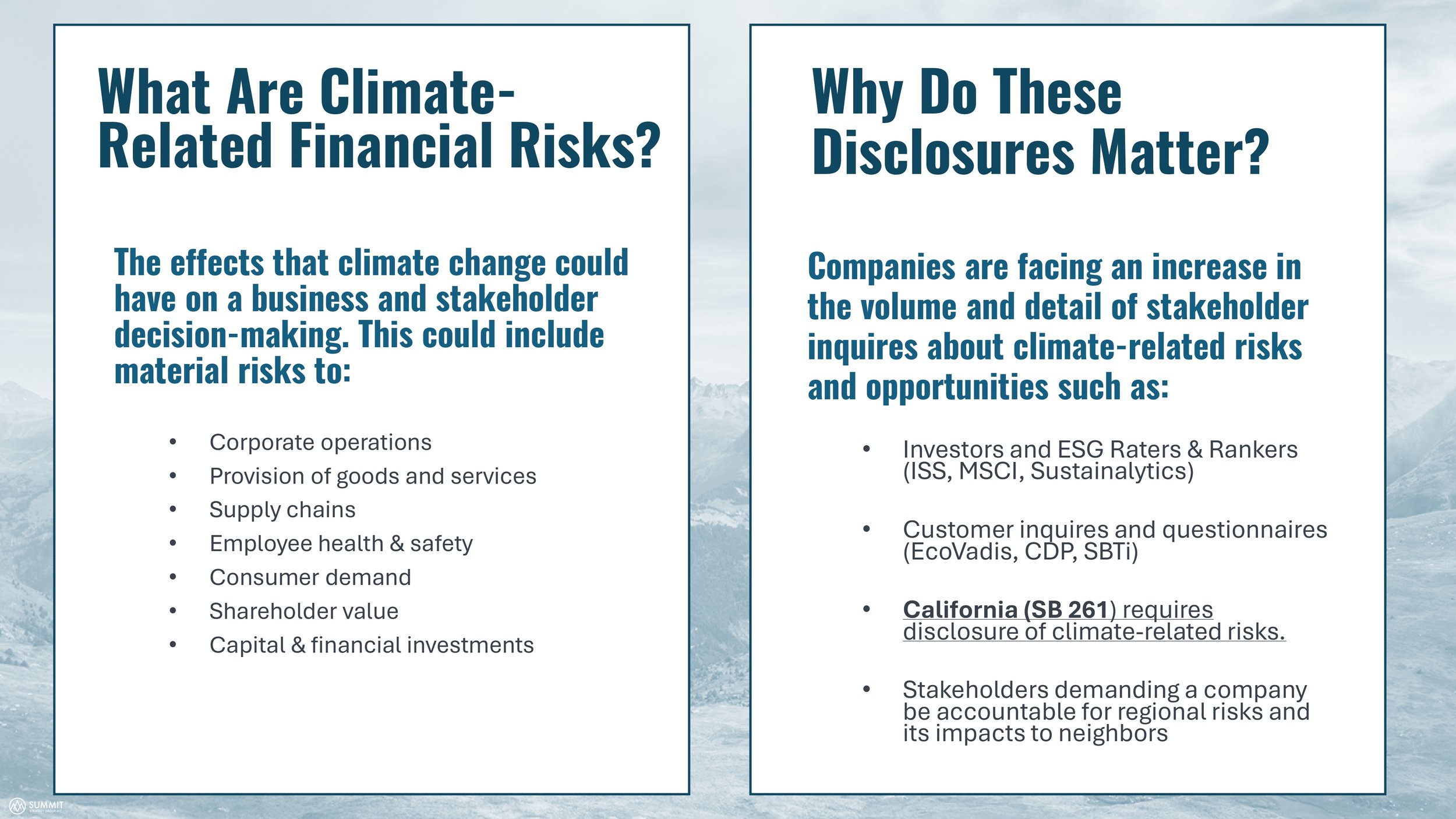

The Climate-Related Financial Risk Disclosure Program (SB 261) from California is super-charging demand for comprehensive, investor-grade climate risk disclosures from private and public companies alike. But the benefits of conducting a climate risk assessment go far beyond just compliance.

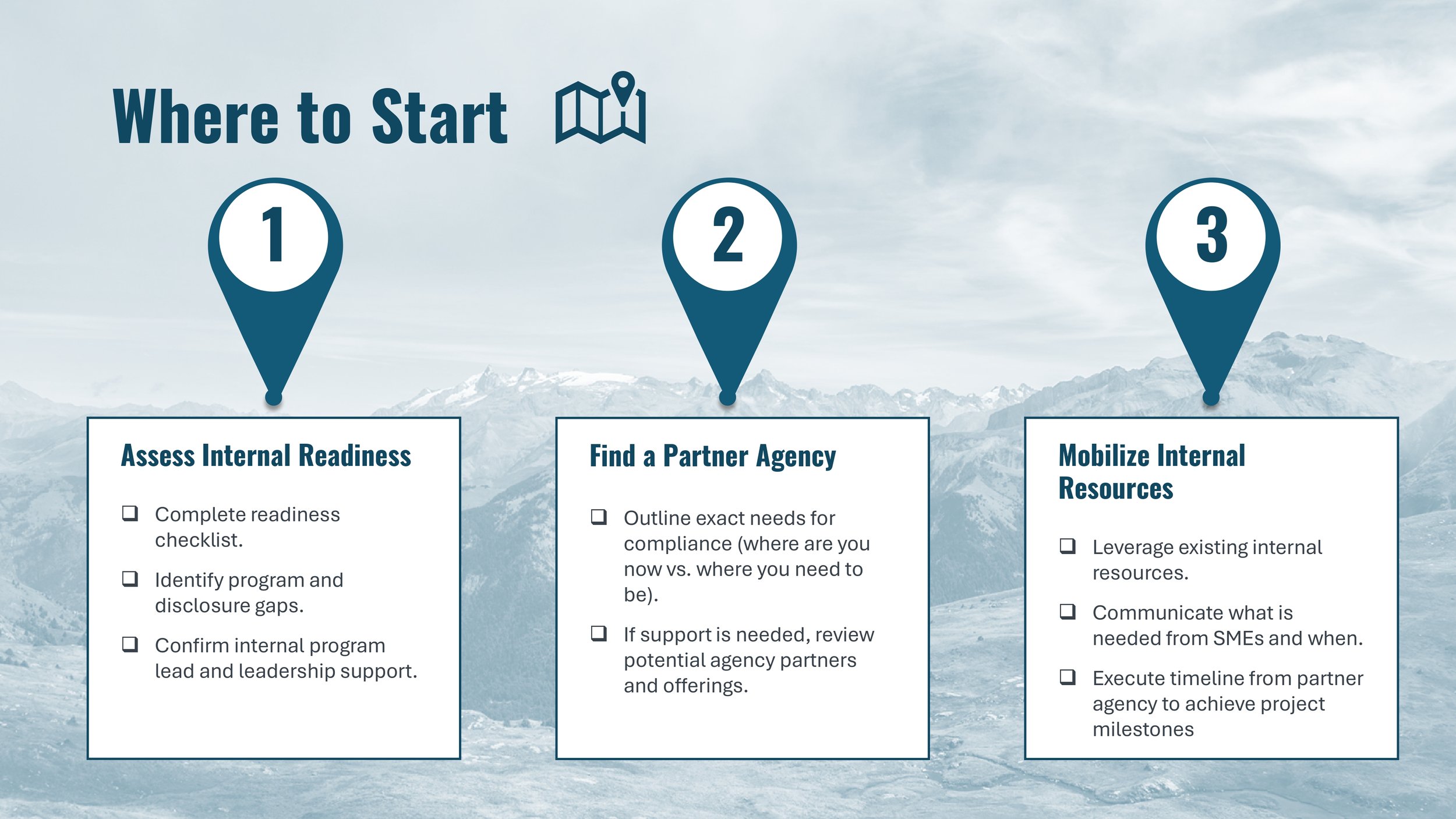

In this guide you will learn how to stay ahead of compliance deadlines while engaging with internal and external stakeholders to identify climate-related risks and capture opportunities. We will cover:

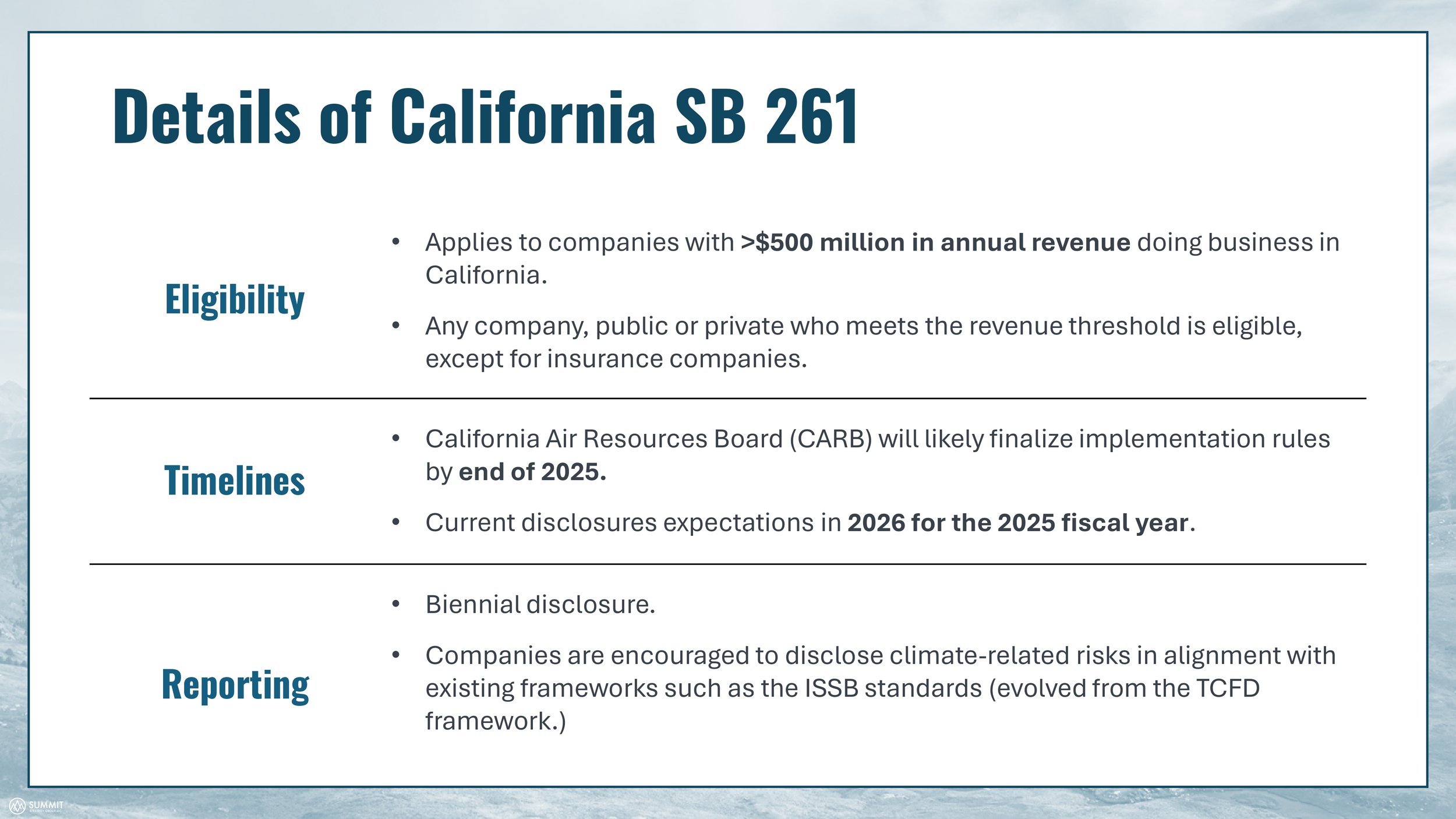

Details of California SB 261

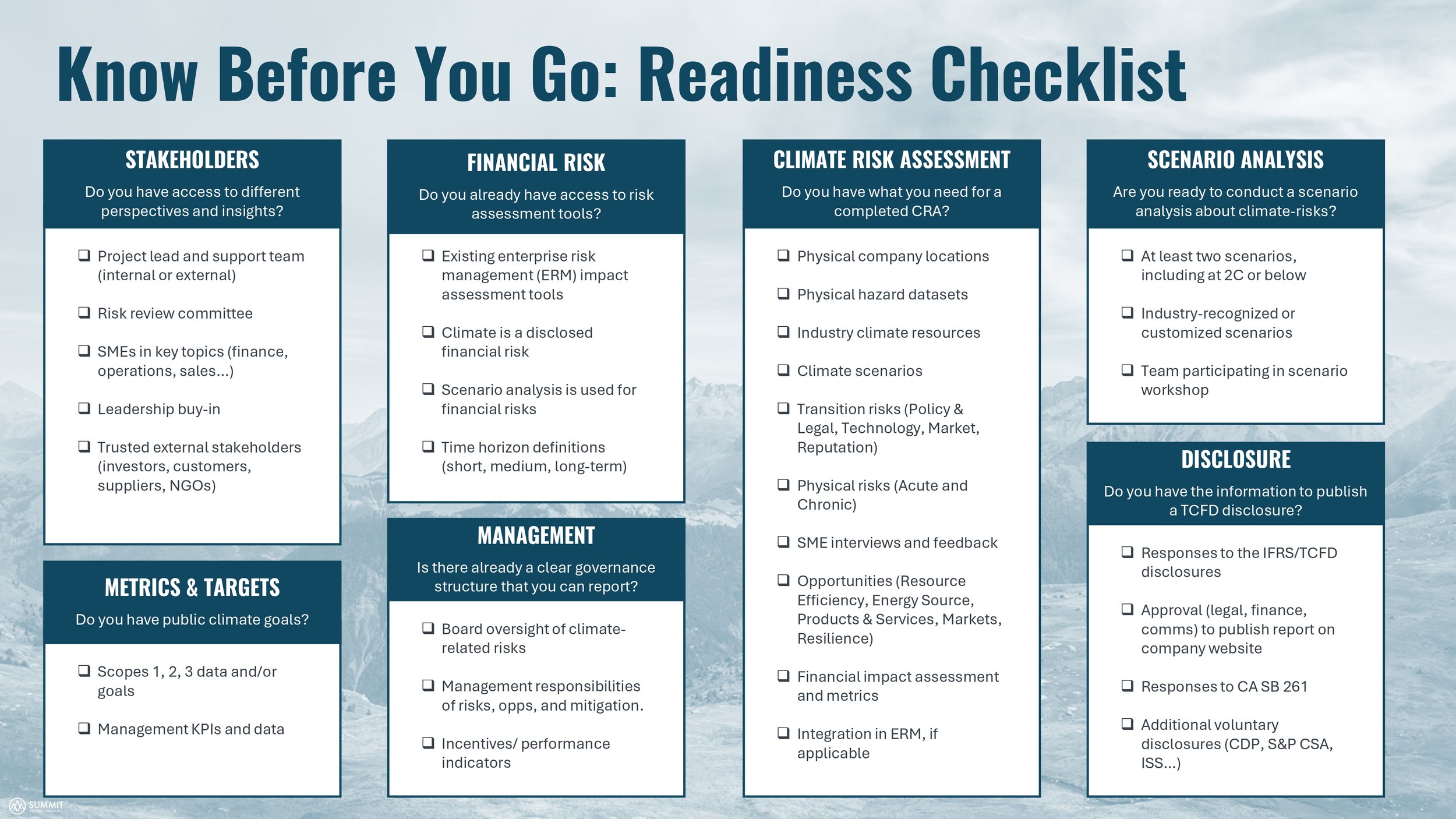

Climate Risk Assessment Readiness Checklist

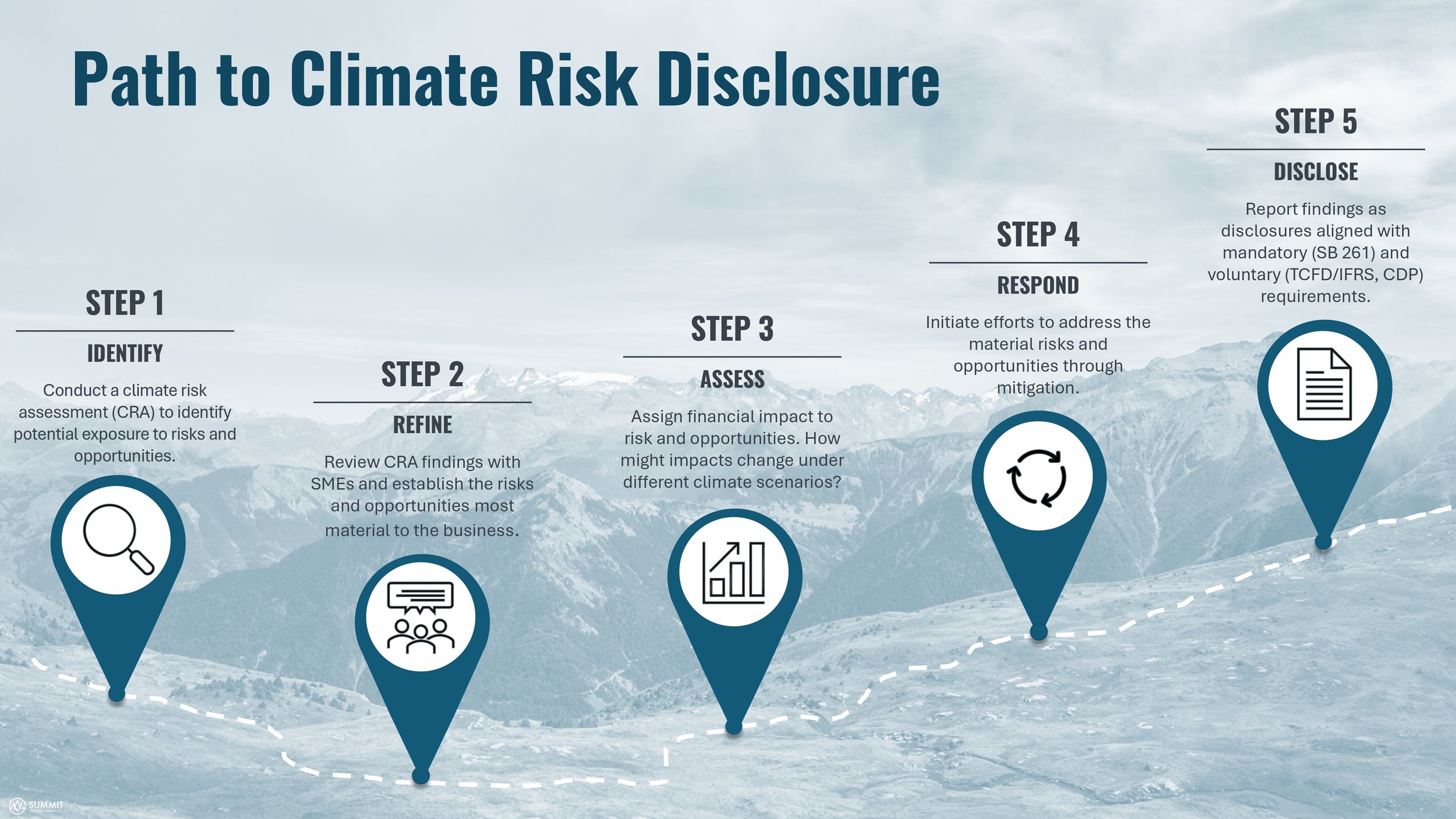

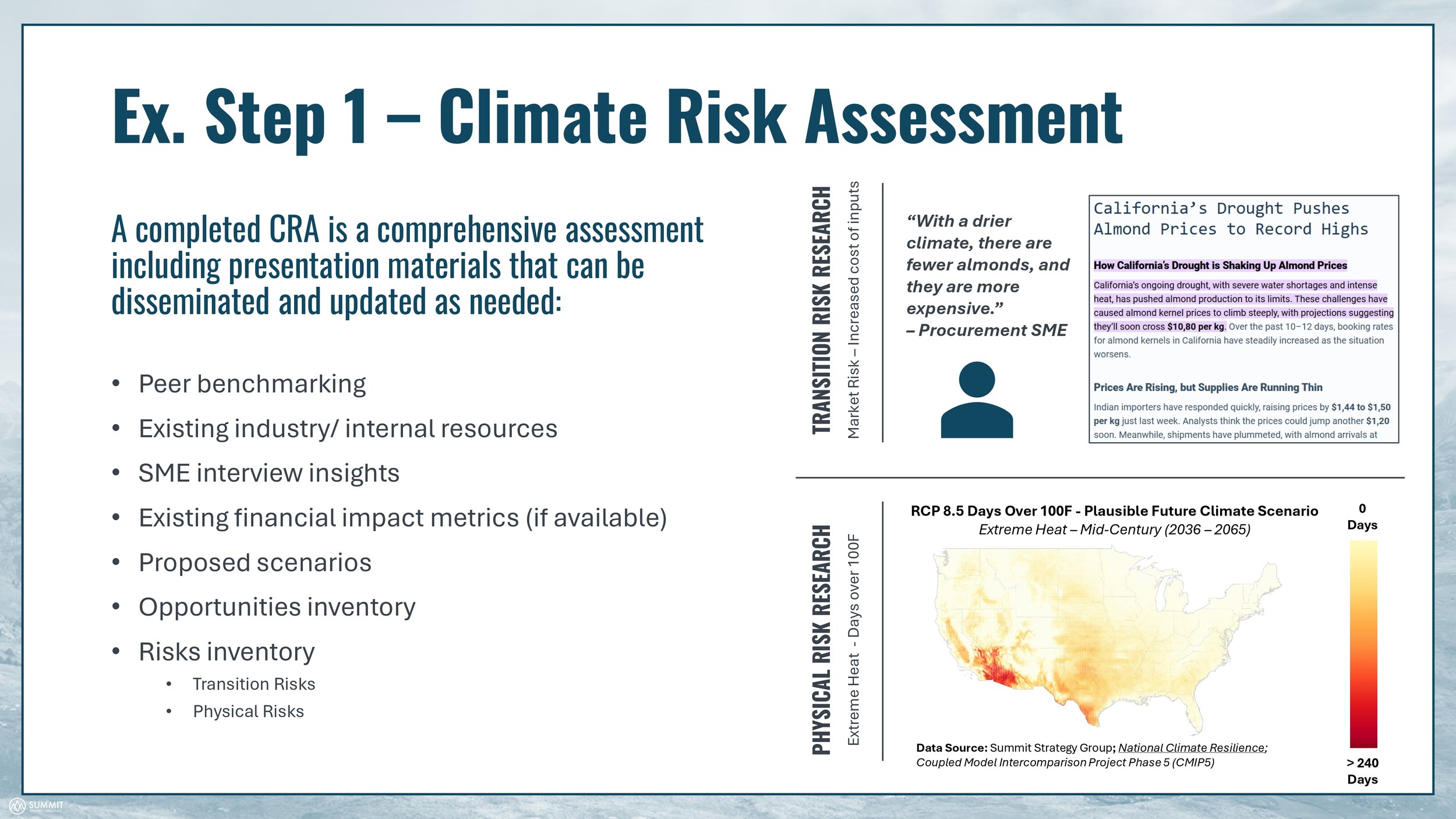

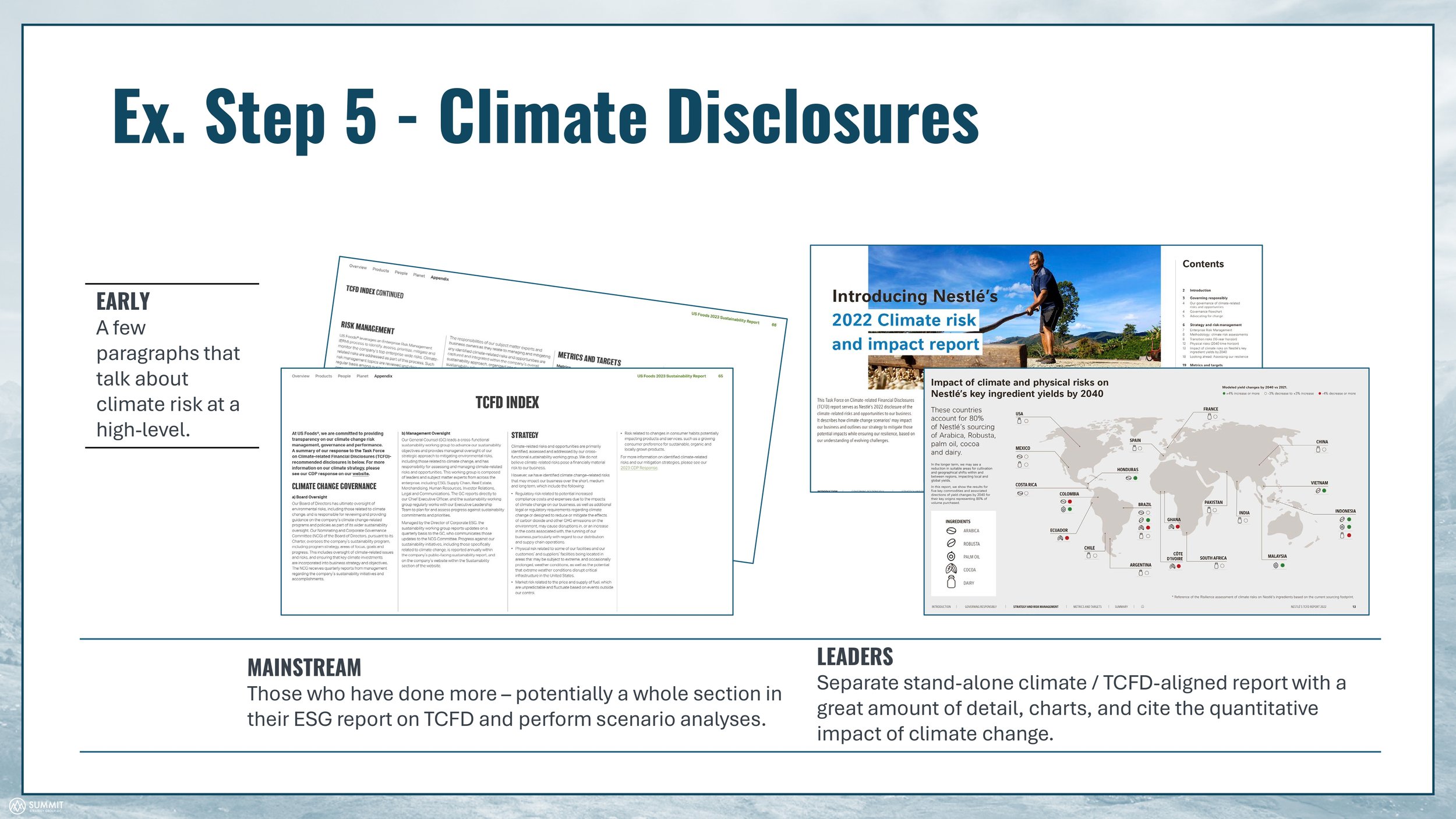

Steps to a successful risk disclosure and examples

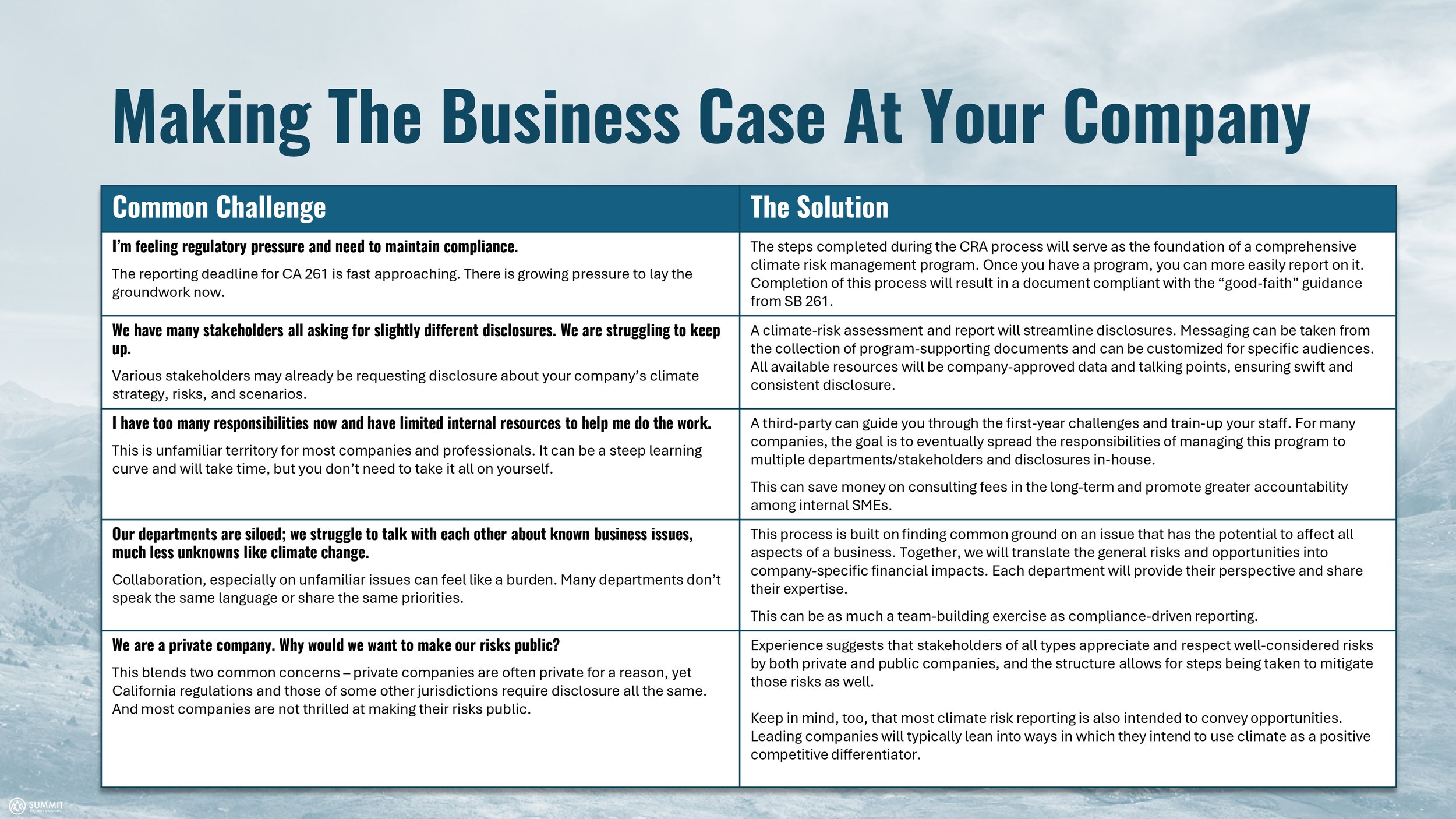

Common questions and making the business case

Download the guide to get clarity on SB 261, climate risks, and disclosure best practices.

Contributor Spotlight: Talia Ibarguen

Talia is a technical sustainability expert specializing in making complex topics accessible through stakeholder engagement, written narratives, data visualization, public speaker training, and compelling presentations.

As a consultant, she has advised clients ranging from Fortune 500 companies and startups to trade organizations, government agencies, and NGOs. She has extensive experience in environmental and sustainability topics including GHG emissions, climate risks analysis, water conservation, and biodiversity.